"Household spending growth is projected to slow gradually, as consumers respond to a slowing in income growth, while investment spending continues to decline."

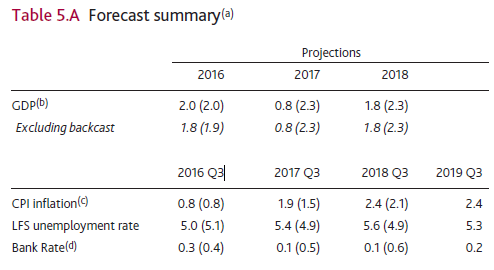

In the Bank of England's latest Inflation Report, the market-implied path for Bank Rate drops to 0.1% throughout 2017 and 2018, before beginning to rise in 2019.

Following the vote to leave the European Union, the Bank said that "the outlook for growth in the short to medium term has weakened markedly".

The Bank predicts "little growth in GDP in the second half of the year", and growth is now projected to slow to 0.1% in 2016 Q3.

It added that "household spending growth is projected to slow gradually, as consumers respond to a slowing in income growth, while investment spending continues to decline".

In a much-anticipated move, the Bank of England’s Monetary Policy Committee today voted to cut the base rate to 0.25% and has announced plans to introduce a package of measures designed to provide additional monetary stimulus.

A majority of members also expect to support a further cut in Bank Rate later this year. The MPC "currently judges this bound to be close to, but a little above, zero".

Forward-looking indicators suggest that both housing transactions and house price inflation may decline further.

Overall, house prices are projected to decline a little over the near term, while the level of transactions remains broadly flat.

The Bank said that subdued housing activity will also effect housing-related investment in the near term.

Weaker housing market sentiment is projected to dampen investment in new buildings, with the report noting that large falls in housing transactions during the early stages of the financial crisis were soon followed by reductions in house building.